Secure over the phone payments for agents

A PCI compliant service, keeping your agents in conversation with the customer

- Higher conversion of call to payment ratio

- Improved customer experience & brand image

- Reduces ongoing costs with a consecutive use approach

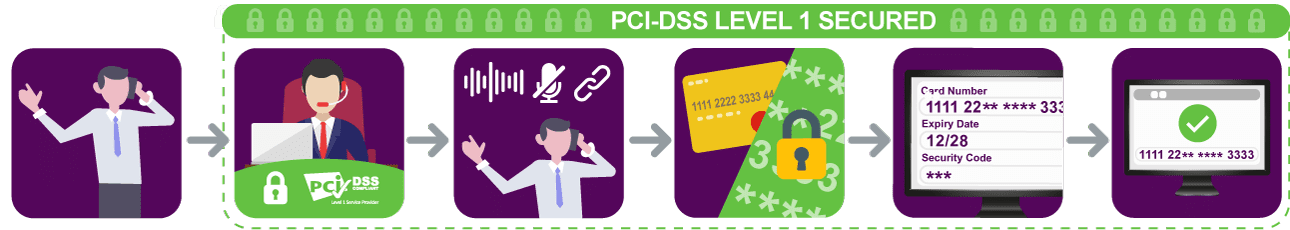

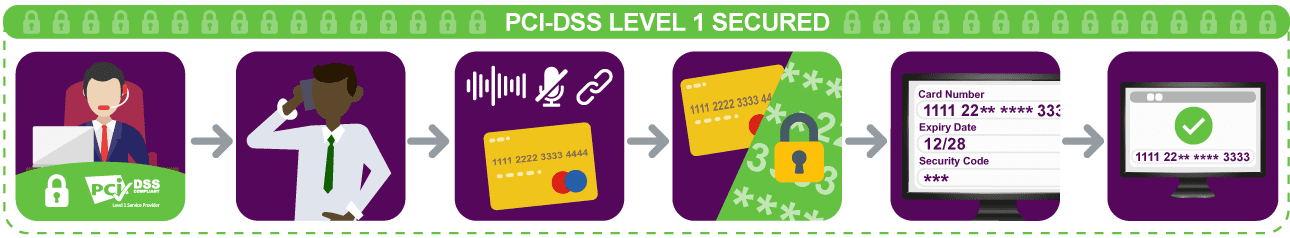

How it works

De-scope your entire office and remote-working environments by ensuring the payment data never reaches your systems.

All sensitive payment details are removed from the call, reducing the risk of a data breach and creating better customer trust.

- Reconcile payments easily with minimal to no change to your current processes

- Give your customers peace of mind that their information is safe by removing sensitive cardholder data from your organisation

- It can be used anywhere, whether your agents are at home or in the office, allowing for flexible working environments

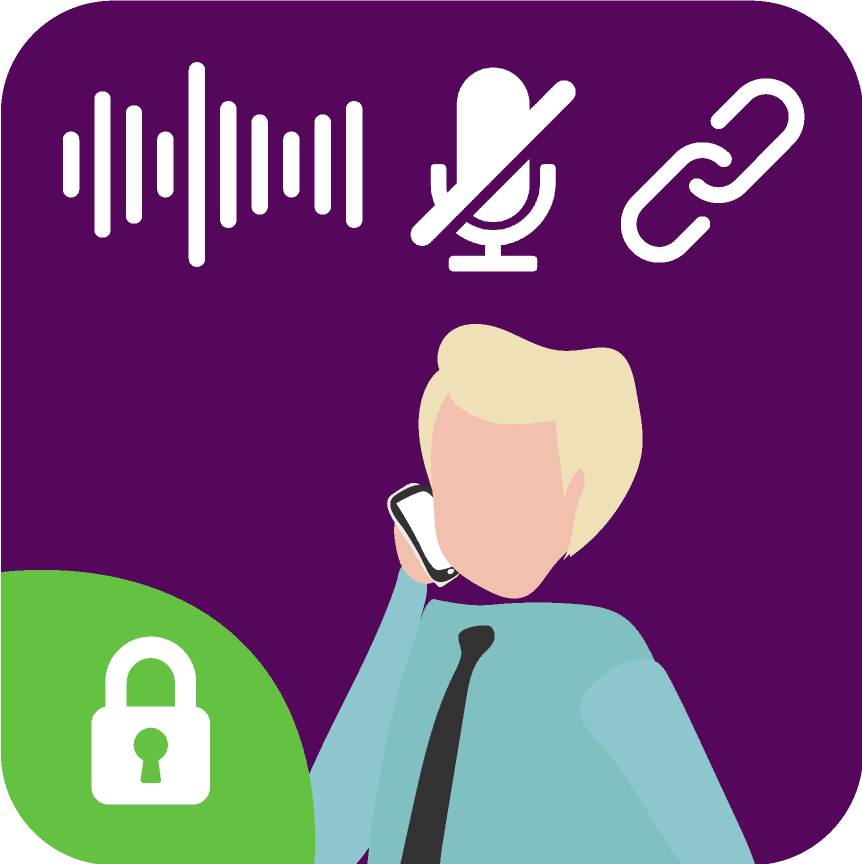

- Caters for wide demographics with 3 data capture methods – secure voice recognition, digital payment link or DTMF-suppressed telephone keypad entry

Choose your data capture methods…

There are three ways for a Customer to make a PCI-DSS compliant payment with an Agent over the phone.

Your solution can be configured to use a combination of methods… all fully secure to the highest level of PCI-DSS compliance.

Voice Recognition

Customers can read out sensitive account and cardholder data (CHD) securely. Agents wont hear these details, and all systems and call recordings stay out of scope. Powered by our Automatic Speech Recognition (ASR) engine.

Agent Digital

Customers receive a text and email with a link to input card details securely, with no need to secure the call.

You can descope your payment collection by 100%, ensuring maximum security for your customers.

Keypad Entry (DTMF)

Customers input sensitive card details into their telephone keypad.

DTMF tones are masked so you'll have no concerns that the cardholder data can be exposed at the other end.

How Clothes2order achieved

PCI compliance and a smoother ordering process

Simon Turner - Marketing Director

"Customer engagement has drastically improved since introducing the service. The Agent Assisted solution means we don’t have to worry about pausing recordings mid-way through a call, or asking people to read their card details out loud, something they may feel uncomfortable doing."

Simon Turner - Marketing Director

"Customer engagement has drastically improved since introducing the service. The Agent Assisted solution means we don’t have to worry about pausing recordings mid-way through a call, or asking people to read their card details out loud, something they may feel uncomfortable doing."

How Clothes2order achieved

PCI compliance and a smoother ordering process

Clothes2order needed a secure over the phone solution to process custom clothing orders.

How did Agent Assisted Payments solve their challenge?

Give flexibility and freedom with a range of payment options

Debit & Credit Card

PayPal & Digital Wallets

Buy Now Pay Later

3 options to suit you…

There are three ways for a Customer to make a PCI-DSS compliant payment with an Agent over the phone.

Your solution can be configured to use a combination of methods, all fully secure to the highest level of PCI-DSS compliance.

1

2

3

4

5

6

1

2

3

4

5

6

1

2

3

4

5

6

1

2

3

4

5

6

1

2

3

4

5

6

1

2

3

4

5

6

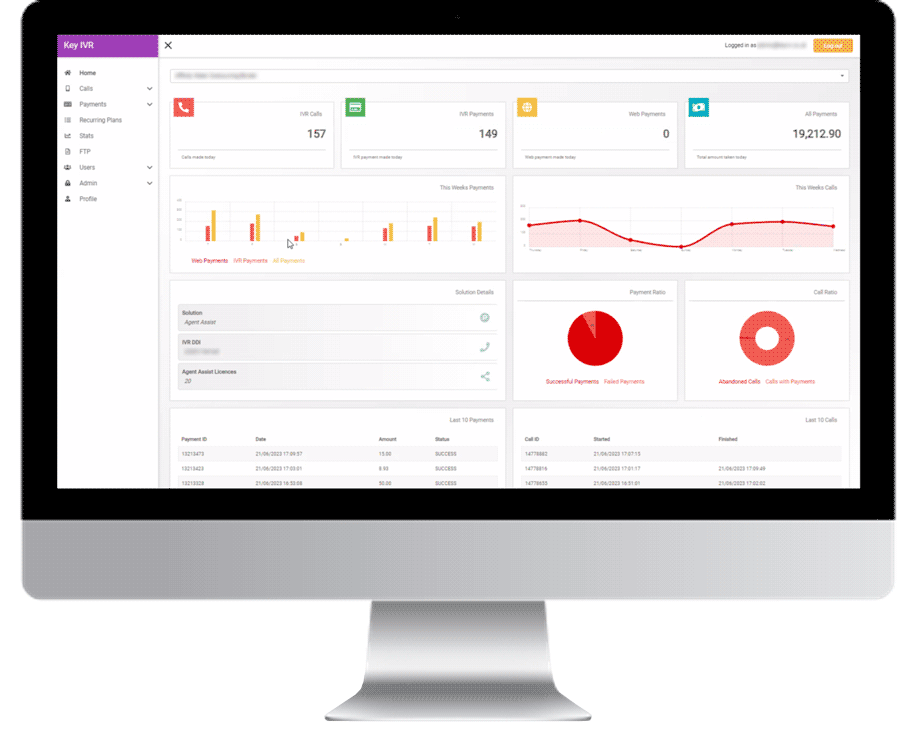

Track payments & activity on your Client Portal

- Real time and historical reporting across all your payment services

- Monitor payment volume, payment status, call volume, call abandonment rate, recurring payment plans, licences and much more

- Download payment and call log reports

- Intuitive and easy to use

- Set user access controls for admins and users with limited control

Service additions

There are a multitude of additions we provide to tailor your Agent Assisted Payment solution.

Your solution can be configured to suit your business needs, all fully secure to the highest level of PCI-DSS compliance.

Secure Voice Recognition

Capturing non-numerical information from your customers on a telephone keypad is impossible. However, it can be important to capture the details have no numbers or a mix of alphanumerics – such as name, postcode, National Insurance number or car registration.

Additionally, using a telephone keypad to input account information or card details can be challenging for some customers, especially for those with a severe physical disability.

To cater for all demographics and information formats, our Payment IVR service can be configured to prompt the customer to speak details out loud, accurately deciphering their answers and progressing to the next step.

Card details are verified and processed securely. The system will mute the call as sensitive details are spoken, so any call recordings are out-of-scope and you remain PCI-DSS compliant.

Direct Debit Payments

Add Direct Debit to your payment solution and start securing collections through one of the most trusted channels in the UK.

Set up, modify and monitor Direct Debits simply and conveniently, avoiding the hassle of chasing a multitude of late payments. Options include: payment plans and one-off transactions to collect variable amounts, subscription payments and fixed fees alike.

Tokenisation

Tokenise a customer’s card, meaning they will only need to provide card details once, saving them time on regular payments and purchases.

All payments are secure as card details are not stored anywhere outside the issuing card company, with tokens containing a dedicated reference for every individual customer.

E.g. Policy number, customer number, customer name, phone number, etc.

Recurring Payments

Offer your customers a Recurring Payment Plan with a range of payment frequencies, such as weekly, fortnightly, monthly, etc.

A Recurring Payment Plan / CPA (Continuous Payment Authority) differs from a Direct Debit as you can re-take failed payments, restarting the plan and avoiding expensive failed payment charges.

This method is recommended by the FCA, as debt isn’t added onto customers paying off existing debt.

SFTP Integration

Validate your customer transactions and avoid matching every transaction and investigating human errors.

You’ll have the option to supply customer records or a list of outstanding payments so transactions can be validated as a customer makes a payment.

Bespoke API Integration

Our solutions are compatible with many different APIs, allowing integration with hundreds of different platforms.

If necessary, a bespoke API can be developed to work seamlessly with your business systems.

Submit your details and a payment specialist will be in touch.

We’d be happy to show you Agent Assisted Payments in action, discuss your requirements and pricing.

Sophie Chan

Head of Account Management

Services that work for everyone, including…

Debt Recovery

Housing

Travel Agents

Charities

Services that work for everyone, including…

Debt Recovery

Housing

Travel Agents

Charities

Contact Centre Teams

Debt Collection & Enforcement

Collection and card processing needs to be fast, reliable and convenient for both debtors and your staff. Whether you take payments on the phone, via an automated IVR, online or in person we can provide a bespoke, PCI-DSS Compliant solution, comprised of payment methods that work seamlessly together

Utility Suppliers & Providers

Travel Agencies & Tour Operators

Our services can be tailored to meet the specific needs of the travel sector, providing a range of payment methods to suit your individual requirements

Property Management & Housing Associations

Managing and maintaining the incoming funds from tenants is a crucial day-to-day process for any housing association, But, keeping track of this can often be tricky, especially when there are many areas to oversee

Charities & Not for Profit

Managing and maintaining the incoming funds from tenants is a crucial day-to-day process for any housing association, But, keeping track of this can often be tricky, especially when there are many areas to oversee

With Key IVR’s PCI-DSS compliant solutions, not for profit organisations can offer their donators the best experience during the fund-raising process – along with protecting their sensitive data